Cloud native, CMS backed. Azure, Azure DevOps Services and Blazor.

PROJECT DETAILS

Website : LV.Com website

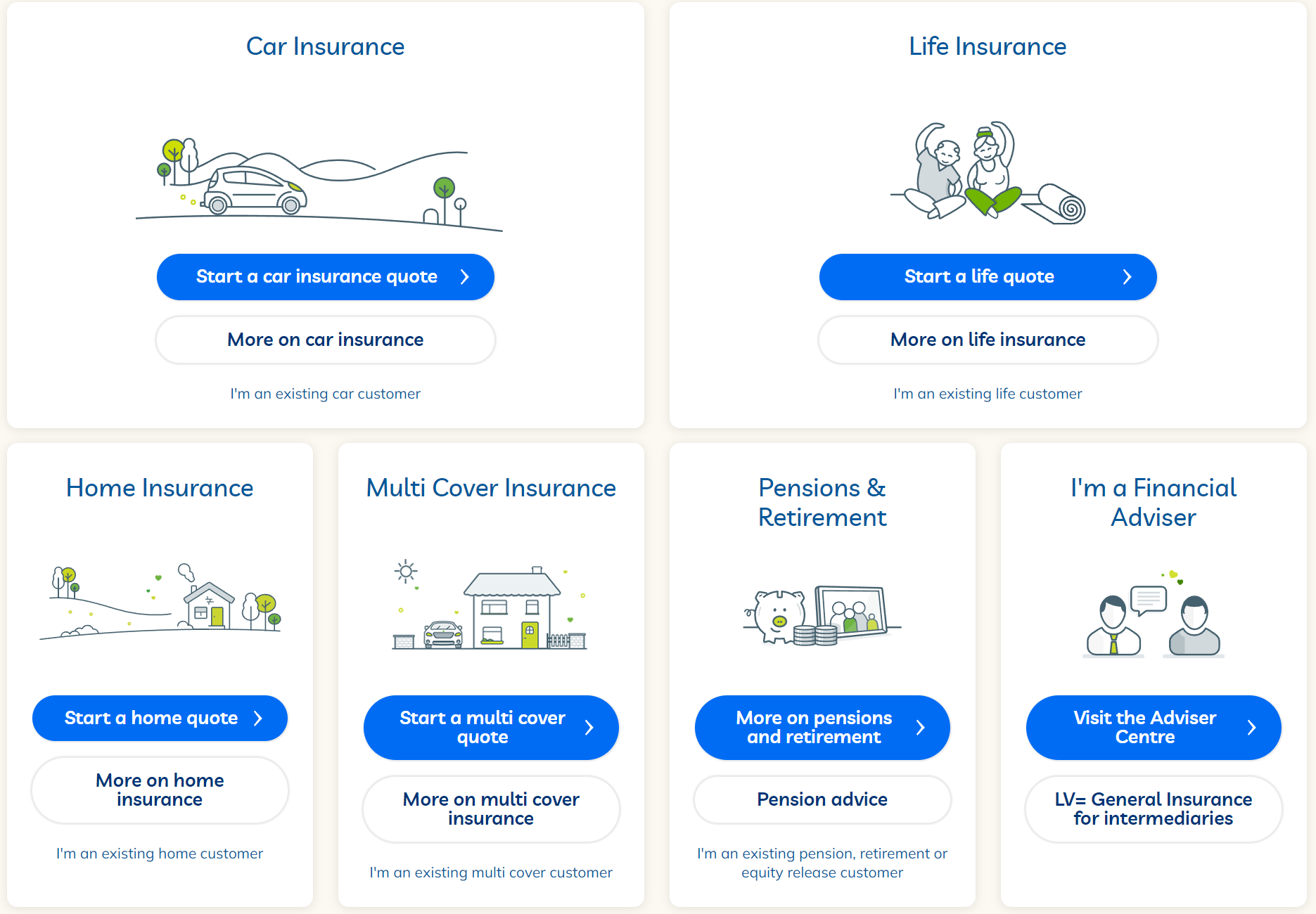

Multi Car, Car, Home, Pet, Travel, Life Insurance, Retirement And Pensions.

Overview

Liverpool Victoria is the largest friendly society in the UK.

The LV.com website acts as the gateway and touch point to the rest of the business and thus plays a key role for customers and key services.

Assemblysoft's involvement in the LV.com brochureware CMS project demonstrated not only technical expertise but also a keen understanding of regulatory compliance. Amidst limited in-house assistance, we developed a custom DevOps process and navigated the complexities of Financial Conduct Authority (FCA) and prudential regulation requirements, ensuring LV.com's seamless transition to a robust .NET platform over a five-year period.

What is General Insurance Software?

General insurance software online is a digital platform specifically designed to manage the wide array of operations involved in the general insurance sector, covering non-life insurance policies such as automobile, homeowners, travel, and health insurance, among others. This type of software streamlines the creation, distribution, and management of insurance policies, claims processing, customer service, and more. By leveraging technology, general insurance software enhances operational efficiency, improves customer satisfaction, and ensures compliance with regulatory standards.

Benefits of Custom Software Solutions for General Insurance

1. Streamlined Policy Management

Custom insurance software allows for the efficient management of insurance policies from issuance to renewal or cancellation. It can automate routine tasks, such as underwriting, policy issuance, and renewals, reducing manual errors and operational costs.

2. Enhanced Customer Experience

A custom solution can offer policyholders a user-friendly online platform to purchase policies, make payments, submit claims, and access policy information. This digital access improves customer satisfaction by providing convenience and transparency.

3. Automated Claims Processing

Custom software can automate the claims management process, from initial notification to final settlement. It can help in faster claims processing by validating claims, assessing damages, and managing payouts, thereby improving customer trust and satisfaction.

4. Advanced Data Analytics

Integrating data analytics into general insurance software enables insurers to analyze large volumes of data for better risk assessment, pricing strategies, and fraud detection. Analytics can also offer insights into customer behavior, helping to tailor products and services to specific market segments.

5. Improved Regulatory Compliance

Custom software can be designed to ensure compliance with the constantly changing insurance regulations and standards. It can automate reporting, document management, and compliance checks, reducing the risk of non-compliance penalties.

6. Enhanced Security

With the sensitive nature of personal and financial data involved in insurance transactions, custom software solutions can offer robust security measures, including data encryption, secure access controls, and regular security audits, to protect against data breaches and cyber threats.

7. Scalability and Flexibility

Custom insurance software can be scaled to accommodate the growth of the insurance company, allowing for the addition of new insurance products, integration with other systems, or expansion into new markets without compromising performance or security.

How It Benefits All Stakeholders

- Insurance Companies gain a competitive edge through improved operational efficiency, reduced costs, and enhanced capability to innovate and bring new products to market faster. The automation of routine tasks allows staff to focus on higher-value activities.

- Insurance Agents and Brokers benefit from streamlined workflows, easier policy management, and improved communication with policyholders, making it easier to provide high-quality service and increase sales.

- Policyholders enjoy a more convenient and transparent insurance experience, with easy access to policy information, quick claims processing, and the ability to interact with their insurance provider through digital channels.

- Regulatory Bodies can rely on more accurate and timely compliance reporting from insurance companies, ensuring that industry standards are maintained and policyholders are protected.

The Challenge

LV= reached out to us to play a key role in maintaining, customising and developing their bespoke .NET based content management system (CMS) and the front door to the business.

With content changing rapidly on a daily basis by multiple internal teams, there would be much to consider.

If you would like some assistance with .NET MAUI | Azure | Azure DevOps Services | Blazor Development then please get in touch, we would be glad to help.

Compliance, doing the right thing and protecting customers interests are paramount in the day to day activities of the business at every level, ensuring rigorous standards of conduct were maintained at all levels would be paramount.

We were required to be involved in the entire estate, spanning multiple business, technical and compliance teams.

- Limited In-House Assistance: Addressing the project's needs without extensive support or guidance from LV's internal team.

- Navigating Regulatory Compliance: Adhering to stringent financial and prudential regulations set by the FCA.

- Development of Custom DevOps Process: Creating and implementing a bespoke DevOps process to streamline and enhance release cycles.

- Maintaining Operational Efficiency: Ensuring the CMS remained functional and efficient during the long transition period.

FCA: Financial Conduct Authority

www.fca.org.uk

PRA: Prudential Regulation Authority

www.bankofengland.co.uk/prudential-regulation

The Support

We acted as both consultants and worked hands-on fully customising, developing and supporting the LV.com website and supporting services close to 5 years.

We worked intimately with multiple diverse teams and acted as a bridge between them all to deliver change, security best practices, end to end testing, search engine optimization (SEO), analytics, reporting, and a host of other cross-cutting activities to deliver a stable and robust environment for the business to perform it's day-to-day duties.

- Regulatory Adherence: We meticulously ensured that all developments and updates complied with FCA and prudential regulations, a crucial aspect for LV’s financial services.

- Autonomous Operation: We took on the project with minimal external assistance, relying on our internal expertise and resources.

- Custom DevOps Development: Our team developed a bespoke DevOps process that was specifically designed to streamline the development and deployment cycles for the LV.com CMS.

- Continuous System Support and Improvement: Despite the transition to Sitecore, we focused on maintaining and incrementally improving the existing system.

We provided 24/7 support for any technical issues encountered.

We designed processes, built custom tooling and designed and implemented Developer Operations (DevOps) workflows to deliver change in a consistent and robust fashion.

We trained, mentored and onboarded offshore teams.

We supported and maintained the custom content management system (CMS) employed on the LV estate.

We also aided in the digital transformation process to the cloud to bring the tooling and processes forward enabling future capabilities.

We designed and developed the first DevOps pipeline in the cloud spanning Development, Test, Build, Release and Senior stakeholder signoff.

Business Benefits

The project delivered substantial business advantages:

- Regulatory Assurance: Our adherence to FCA and prudential regulations provided LV with confidence in their compliance status.

- Operational Continuity: Our efforts ensured that LV.com continued to serve as the vital front door to LV’s insurance services without interruption.

- Increased Development Efficiency: The bespoke DevOps process enhanced our development agility and efficiency, setting a precedent for future projects.

- Adaptability and Resilience: Our ability to adapt and efficiently manage the project under challenging circumstances demonstrated our resilience and commitment to client success.

Assemblysoft's management of the LV.com brochureware CMS project underlines our ability to not only handle complex technical challenges but also navigate stringent regulatory landscapes. The introduction of a custom DevOps process, coupled with our commitment to regulatory compliance, ensured the project's success during a critical transition period, solidifying our reputation as a provider of reliable and compliant technological solutions.

At Assemblysoft we specialise in Custom Software Development tailored to your requirements. We can onboard and add value to your business rapidly. We are an experienced Full-stack development team able to provide specific technical expertise or manage your project requirements end to end. We specialise in the Microsoft cloud and .NET Solutions and Services. Our developers are Microsoft Certified. We have real-world experience developing .NET applications and Azure Services for a large array of business domains. If you would like some assistance with Azure | Azure DevOps Services | Blazor Development | .NET MAUI Development or in need of custom software development, from an experienced development team in the United Kingdom, then please get in touch, we would love to add immediate value to your business.

Assemblysoft - Your Safe Pair of Hands